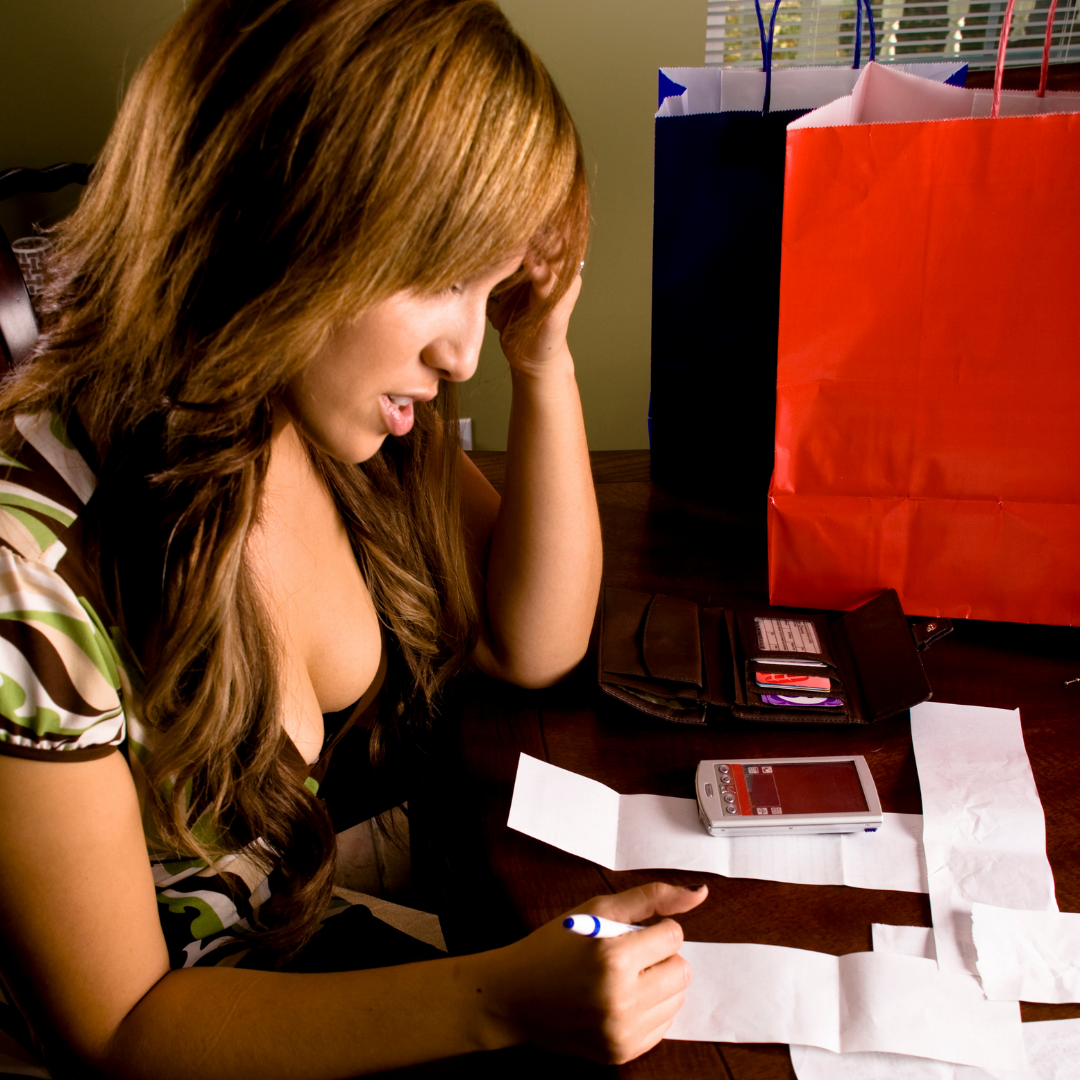

Overspending is a problem that affects many of us. It is often triggered by the desire to acquire something new or trendy. The desire to buy something new can be triggered by a new job, a new vehicle, or a new house. Overspending is not limited by age or gender, and people of all economic backgrounds and social standings can be affected.

What Is Overspending?

Overspending isn’t a new concept. Many people go into debt from time to time, and they are deep in debt before you know it. However, it’s not something that needs constant attention. It’s a habit that can easily be broken, and it’s something you can conquer with a little patience.

People tend to spend more money than they have, and that can cause financial problems. Spending is a good habit since it’s a way to get the things available on the market today, but being too generous with your money can also cause problems.

Overspending is an addiction that seems harmless at first. You buy something you want to use, and once you have it, you feel satisfied for a while and don’t want to stop. The feeling of satisfaction is what gets you to continue buying things that won’t really make you happy. The same thing can be said about overspending. Once you have made a purchase that you can’t afford, you’ll be willing to spend more on other things you don’t need. The feeling you will get from spending money will force you to buy more things you don’t need. Once you have spent all your money on one purchase, you will continue to spend money on other things you don’t really need.

Tips on How To Avoid Overspending

There are a lot of reasons to avoid overspending on your credit cards. A few of them include the impact it can have on your credit score, the potential for fraud, and the huge interest rate you may end up paying. This guide is aimed at helping you make a few small changes that can have a big impact.

There’s no denying that many people are overspending. The biggest culprit is when people can’t resist overpaying for the latest gadget or fancy electronic item. But they don’t have to. Here are some quick tips on how to avoid overspending:

– Stick with what you know. Don’t try something new, and don’t try something new that you already have and don’t like.

– Don’t be too hard on yourself. Everyone makes mistakes. Some just happen to be more expensive than others.

– Don’t let money be the be-all and end-all in life. There are other things that matter more.

Importance of Saving

There are many ways to save money, and most of them are fairly simple. There are also many ways to overspend money, and most of them are relatively simple, too. While we don’t wish to spend more than we need to, inevitably, we will sometimes overspend. The reason is simple: humans are limited in the amount of money they can earn and spend in a lifetime, and some people are simply less cautious than others.

Spend less money. That’s the goal. We all want to. We all want to leave the store with less in our wallets and/or a ton of Christmas gifts. You don’t want to be a bunch of Scrooge-types, but at the same time, you need to be frugal. Saving money is a good thing, but spending money is equally important, maybe even more important. You need to spend money on yourself and invest in yourself. It’s one of the most important things you can do. So, how do you do it?

Overspending can be a problem for anyone and can turn into a real money drain if you don’t know how to stop it. The first step to preventing overspending is to change your mindset. Without a positive mindset, it’s easy to find yourself in a spiral of debt, never able to escape.

Conclusion:

There are many reasons why you may find yourself living beyond your income, including the desire to buy something you don’t really need, the “Stuff” syndrome, or simply living on credit. The truth is that many of us have an uncomfortable relationship with money that prevents us from realizing our financial goals. Overspending is a problem that we can solve, but knowing how to do so is the first step on the journey.